Shares of quantum computing firm Rigetti Computing Inc (NASDAQ:RGTI) surged to a new all-time high on Monday, continuing a 5,900% rally over the past year fueled by strong investor confidence. Here’s what investors need to know.

What To Know: The stock's dramatic ascent follows a recent price target increase from Benchmark, which raised its target to $50. According to the Benchmark analyst, Rigetti is well-positioned to capitalize on the quantum sector’s growing momentum thanks to its solid foundation of government and private-sector contracts.

The company also recently secured $21 million in contracts for 2025 and boasts a $571 million cash reserve to fund its technology roadmap. A key partnership with Nvidia has also bolstered its competitive standing.

The recent contract wins include multi-million dollar agreements with the U.S. Air Force Research Lab and a consortium for the UK’s National Quantum Computing Centre. These deals are being viewed as validation of Rigetti’s chiplet architecture and its four-year technology roadmap.

Despite broader market volatility late last week stemming from renewed trade concerns, Rigetti's focus on developing a 1,000+ qubit, error-corrected quantum system, combined with its solid financial footing, has propelled it to new heights and captured significant attention from Wall Street.

JPMorgan announced Monday that it will invest up to $10 billion to bolster national security. Part of the company’s investment will be focused on frontier and strategic technologies, which includes AI, cybersecurity and quantum computing. Several quantum computing stocks appear to be benefitting from the announcement, including Rigetti.

EXCLUSIVE: Rigetti Leverages Nvidia, Chiplets To Outpace IBM And Google In Quantum Race

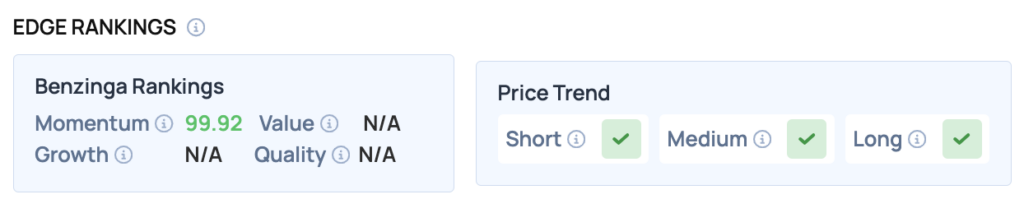

Benzinga Edge Rankings:

RGTI Price Action: Rigetti Computing shares were up 16.52% at $51.18 at the time of publication Monday, according to Benzinga Pro.

The stock is trading significantly above its 50-day ($22.58), 100-day ($17.81) and 200-day ($14.28) moving averages. This indicates a robust bullish trend, with Monday’s all-time high of $51.50 potentially acting as immediate resistance, while the recent low of $46.37 may serve as a support level.

Read Also: USA Rare Earth, Critical Metals Stocks Explode—JPMorgan Adds Fuel To The Fire

How To buy RGTI Stock

By now you're likely curious about how to participate in the market for Rigetti Computing – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

- No comments yet. Be the first to comment!