Rigetti Computing Inc (NASDAQ:RGTI) shares are trading lower Tuesday morning, a day after the quantum computing firm surged to a new all-time high. Here’s what investors need to know.

What To Know: Tuesday’s decline comes amid a broader market downturn, with a lack of negative company-specific news to account for the reversal. Tech stocks, in particular, are facing selling pressure as broader indexes look to retest recent lows.

Tuesday’s negative sentiment is being fueled by lingering concerns over U.S.-China trade tensions and domestic economic uncertainty, which has prompted a wider risk-off mood among investors.

Rigetti’s 170% surge over the past month is backed by strong fundamentals and key strategic wins. A price target increase from Benchmark to $50 ignited the rally, which is further supported by the company’s solid financial position, including $21 million in 2025 contracts and a $571 million cash reserves.

Key partnerships, like one with Nvidia, and a clear focus on its 1,000+ qubit roadmap have fueled investor confidence. Recent contracts with the U.S. Air Force and UK’s National Quantum Computing Centre are also serving as validation of its chiplet architecture and its four-year technology roadmap.

EXCLUSIVE: Rigetti Leverages Nvidia, Chiplets To Outpace IBM And Google In Quantum Race

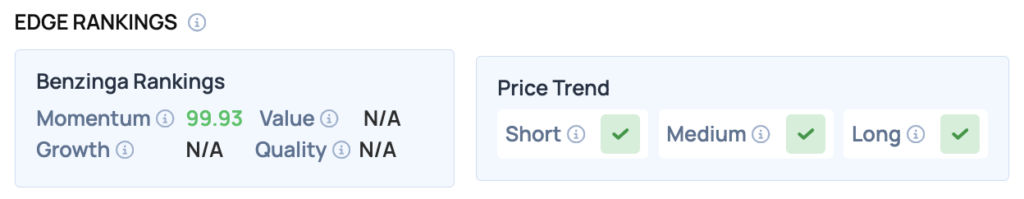

Benzinga Edge Rankings: Reflecting its powerful run, Benzinga Edge stock rankings award Rigetti a near-perfect Momentum score of 99.93.

RGTI Price Action: Rigetti Computing shares were down 4.6% at $52.37 at the time of publication Tuesday, according to Benzinga Pro. Despite Tuesday’s pullback, the stock is significantly above its 50-day moving average of $23.40, indicating strong bullish momentum.

How To Buy RGTI Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Rigetti Computing’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

- No comments yet. Be the first to comment!