Shares of Bitfarms Ltd (NASDAQ:BITF) are bouncing around and trending across social media platforms Tuesday morning. Here’s what investors need to know.

What To Know: Bitfarms shares are falling Tuesday despite a pair of recent announcements aimed at accelerating its strategic shift to a North American energy and digital infrastructure company.

The company announced on Tuesday that CFO Jeff Lucas will retire, effective Oct. 27. Lucas will be succeeded by Jonathan Mir, a finance executive with over 25 years of experience in energy infrastructure and capital markets, most recently at Bank of America.

Bitfarms said the appointment signals a continued focus on the company’s development of high-performance computing and AI infrastructure.

Alongside the leadership change, Bitfarms revealed last week that it has converted a debt facility with Macquarie Group to $300 million in project financing.

The company will draw an additional $50 million to advance its HPC/AI development at its Panther Creek, Pennsylvania data center. Construction is set to begin in the fourth quarter, with the site expected to be energized by the end of 2026.

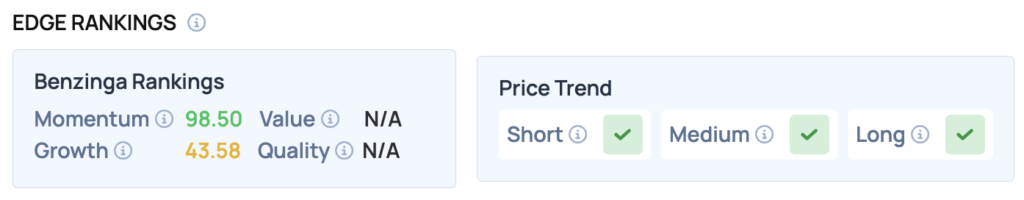

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock boasts an exceptionally strong Momentum score of 98.50.

BITF Price Action: Bitfarms shares were up 0.37% at $5.40 at the time of publication Tuesday, according to Benzinga Pro. The stock is trading near its 52-week high of $5.42.

Bitfarms stock is trading well above its 50-day, 100-day and 200-day moving averages, indicating a strong bullish trend over the longer term. Immediate support is observed around the recent low of $4.69, while resistance is noted near the 52-week high of $5.42.

Read Also: Bitcoin Slides Below $112,000 As Ethereum, XRP, Dogecoin Drop Over 3% On Early Tuesday

How To Buy BITF Stock

By now you're likely curious about how to participate in the market for Bitfarms – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

- No comments yet. Be the first to comment!