The CEO of Futurum Group, Daniel Newman, blasted the current wave of bearish sentiment surrounding Nvidia Corp. (NASDAQ:NVDA) on Tuesday, calling the theories that forced the chip behemoth to formally deny comparisons to historical frauds as “garbage.”

Check out NVDA’s stock price here.

Newman Blasts Rumors That Forced Nvidia's ‘Not Enron' Memo

Newman took to X on Tuesday to express exasperation that a dominant tech leader was forced to address such extreme allegations.

“The fact $NVDA needed to even write a memo explaining it isn't ‘Enron' is a testament to the power of viral stupidity,” Newman wrote. He added that such extraordinary defensive measures wouldn’t be required if “garbage conspiracy nonsense didn’t spread so easily.”

NVDA Sends Out Memo Clarifying Its Accounting Processes

Newman's defense follows reports that Nvidia sent a private memo to Wall Street analysts explicitly refuting claims that its current financial situation is analogous to accounting scandals like Enron or WorldCom.

According to reports of the memo obtained by Barron‘s, Nvidia pushed back hard on the accounting accusations, stating its business is “economically sound” with transparent reporting.

The company emphasized that, “Unlike Enron, NVIDIA does not use Special Purpose Entities to hide debt and inflate revenue.”

NVDA’s Defense Comes Amid Burry’s Accusations

The defensive posture from Nvidia comes amid intensified scrutiny from prominent bears, most notably “Big Short” investor Michael Burry.

Burry recently launched a newsletter attacking Nvidia’s role in the AI boom, comparing its trajectory to Cisco Systems Inc.‘s (NASDAQ:CSCO) during the dot-com crash.

He further argued that Nvidia’s $112.5 billion in share buybacks since 2018 added “zero” value because they merely offset dilution from employee stock compensation.

Nvidia Outperforms Nasdaq In 2025

Nvidia shares have outpaced the broader market this year, climbing 31.99% year-to-date compared to returns of 18.63% for the Nasdaq Composite and 18.58% for the Nasdaq 100.

On Monday, the stock finished the regular session up 2.05% at $182.55 apiece, before falling by 1.50% in extended trading. Over the last year, the stock has gained 34.21%.

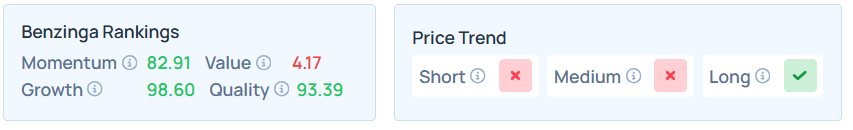

It maintained a stronger price trend over the long term and a weak trend in the short and medium term, with a poor value ranking. Additional performance details, as per Benzinga Edge’s Stock Rankings, are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: Michael Vi / Shutterstock

- No comments yet. Be the first to comment!