Front Running

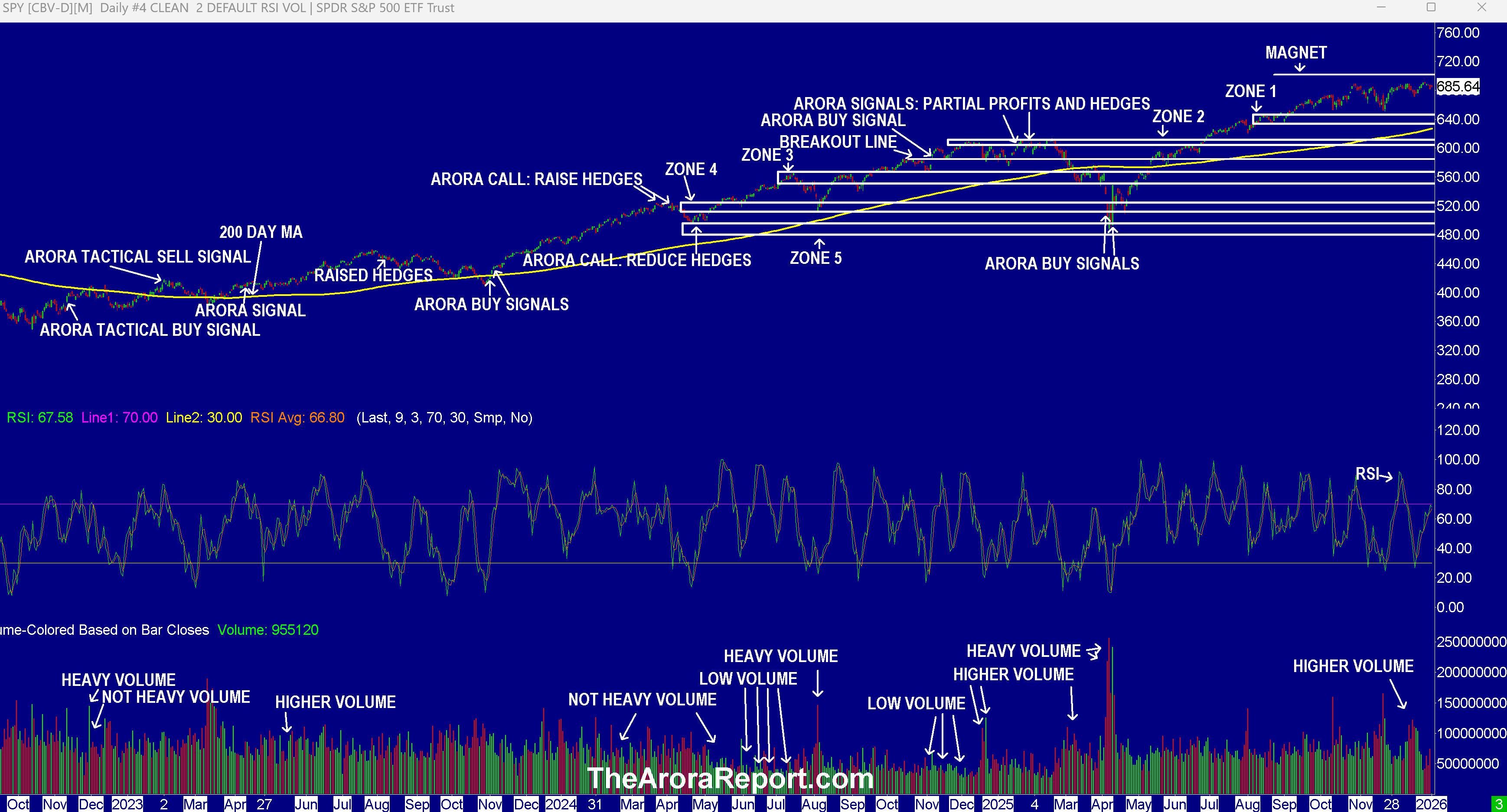

Please click here for an enlarged chart of SPDR S&P 500 ETF Trust (NYSE:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows that in spite of the best efforts of momo gurus and extremely aggressive momo crowd buying, the stock market failed to reach the magnet in 2025.

- The chart shows that so far the Santa Claus rally has not materialized the way bulls expected. This is a negative.

- Expect momo gurus to try very hard to push the stock market to the magnet.

- This morning, Wall Street is front running blind money. Wall Street expects to sell stocks at higher prices to blind money this afternoon or Monday. Blind money is the money that flows into the stock market on the first two days of the month without any analysis or regard for market conditions. Blind money flows are especially strong on the first two trading days of January.

- On the negative side, many investors have been holding off selling stocks to avoid paying capital gains taxes for 2025. Now that the calendar has turned, expect many investors to sell stocks to book gains. Prudent investors know that unrealized gains can quickly disappear. One of our tenets of is to always be in the mode of realizing some profits.

- Beyond the short term crosscurrents, prudent investors need to be mindful that every single major Wall Street bank is very bullish on the stock market for 2026. The best way to understand the implication is to think of a boat where everyone is crowded on one side, hanging over the edge. Everything goes smooth, but if there is a storm, the boat can easily capsize because of uneven weight distribution.

- When it is all said and done, the new year targets put out by Wall Street analysts end up doing investors more harm than good.

- Corporate insiders took advantage of the strong market in 2025 and unloaded billions of dollars of shares.

- The momo crowd was more powerful than ever before in 2025. Expect the momo crowd to be extremely aggressive in the stock market in 2026.

- As usual, expect smart money to be data dependent in 2026. Also expect smart money to have significant protective measures in place.

- Looking ahead, January 9 and 13 will be very important days. January 9 will see the first jobs report not impacted by the government shutdown. January 13 will see Consumer Price Index (CPI) data.

- Earnings season is ahead and will be the major determinant of the stock market direction. Earning estimates are very bullish.

- As investors look forward, investors need to be mindful that the stock market is primed for perfection. Prudent investors should position themselves to take advantage if perfection truly occurs but also be mindful that there is no cushion if earnings or interest rates are worse than the perfect scenario. There is no room for error or adverse events.

- The U.S. dollar experienced the worst year since 2017. This drove the dollar debasement trade, making gold have the best year since 1979. Going forward, prudent investors should be very concerned about U.S. government policies and attempts by China that are leading to dollar debasement. In the short term, dollar debasement is positive for the stock market, but it is a negative for the stock market in the long term.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are positive in Apple Inc (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc Class C (NASDAQ:GOOG), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are positive in S&P 500 ETF (SPY) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (NYSE:USO).

Gold And Silver

CME again raised margin on silver. This is a negative for silver. On the positive side, starting today, China is restricting exports of refined silver. Momo gurus' predictions of silver going to $100 in 2025 did not come true. Keep in mind that a vast majority of momo gurus only jumped in on the silver bandwagon over the last month or two and do not have a long history of accurate silver and gold analysis.

Oil

OPEC+ is likely to maintain its present output at its meeting this weekend. This is putting pressure on the price of oil this morning.

Bitcoin

Bitcoin (CRYPTO: BTC) is seeing buying.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

- No comments yet. Be the first to comment!