During the last three months, 9 analysts shared their evaluations of Nuvation Bio (NYSE:NUVB), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 4 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

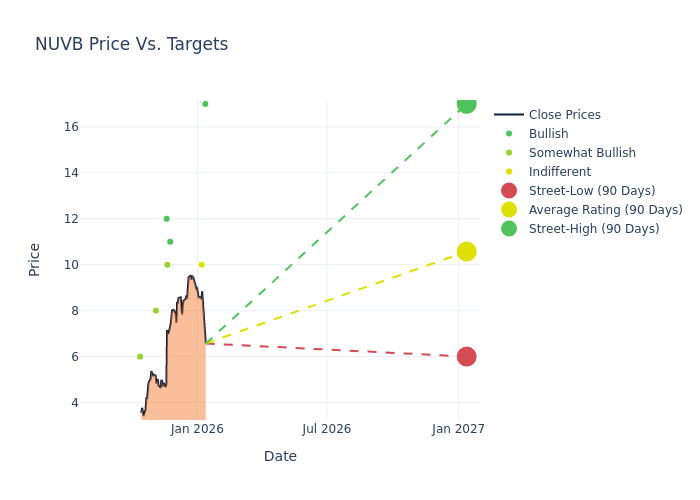

Insights from analysts' 12-month price targets are revealed, presenting an average target of $11.56, a high estimate of $18.00, and a low estimate of $8.00. Observing a 17.6% increase, the current average has risen from the previous average price target of $9.83.

Deciphering Analyst Ratings: An In-Depth Analysis

A comprehensive examination of how financial experts perceive Nuvation Bio is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $17.00 | $18.00 |

| Michael Yee | UBS | Announces | Neutral | $10.00 | - |

| Robert Burns | HC Wainwright & Co. | Raises | Buy | $18.00 | $10.00 |

| Robert Burns | HC Wainwright & Co. | Maintains | Buy | $10.00 | $10.00 |

| Gregory Renza | Truist Securities | Announces | Buy | $11.00 | - |

| Silvan Tuerkcan | Citizens | Raises | Market Outperform | $10.00 | $8.00 |

| Mayank Mamtani | B. Riley Securities | Announces | Buy | $12.00 | - |

| Leonid Timashev | RBC Capital | Raises | Outperform | $8.00 | $7.00 |

| Silvan Tuerkcan | Citizens | Raises | Market Outperform | $8.00 | $6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Nuvation Bio. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Nuvation Bio compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Nuvation Bio's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Nuvation Bio's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Nuvation Bio analyst ratings.

Get to Know Nuvation Bio Better

Nuvation Bio Inc is a biopharmaceutical company tackling unmet needs in oncology by developing differentiated and novel therapeutic candidates. Its product candidate, taletrectinib, is an oral, potent, central nervous system-active, selective, next-generation c-ros oncogene 1 (ROS1) inhibitor specifically designed for the treatment of patients with ROS1+ non-small cell lung cancer (NSCLC). In addition, its clinical-stage pipeline includes differentiated, novel oncology product candidates such as Safusidenib, NUV-1511, and NUV-868 in their different stages of development. The company generates revenue through out-licensing collaborative agreements with its customers located in China and Japan.

Breaking Down Nuvation Bio's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Nuvation Bio's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1704.68% as of 30 September, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Nuvation Bio's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -425.24%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Nuvation Bio's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -15.97%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Nuvation Bio's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -8.94%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a below-average debt-to-equity ratio of 0.18, Nuvation Bio adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

- No comments yet. Be the first to comment!