Beneficiaries Of AI Second Act

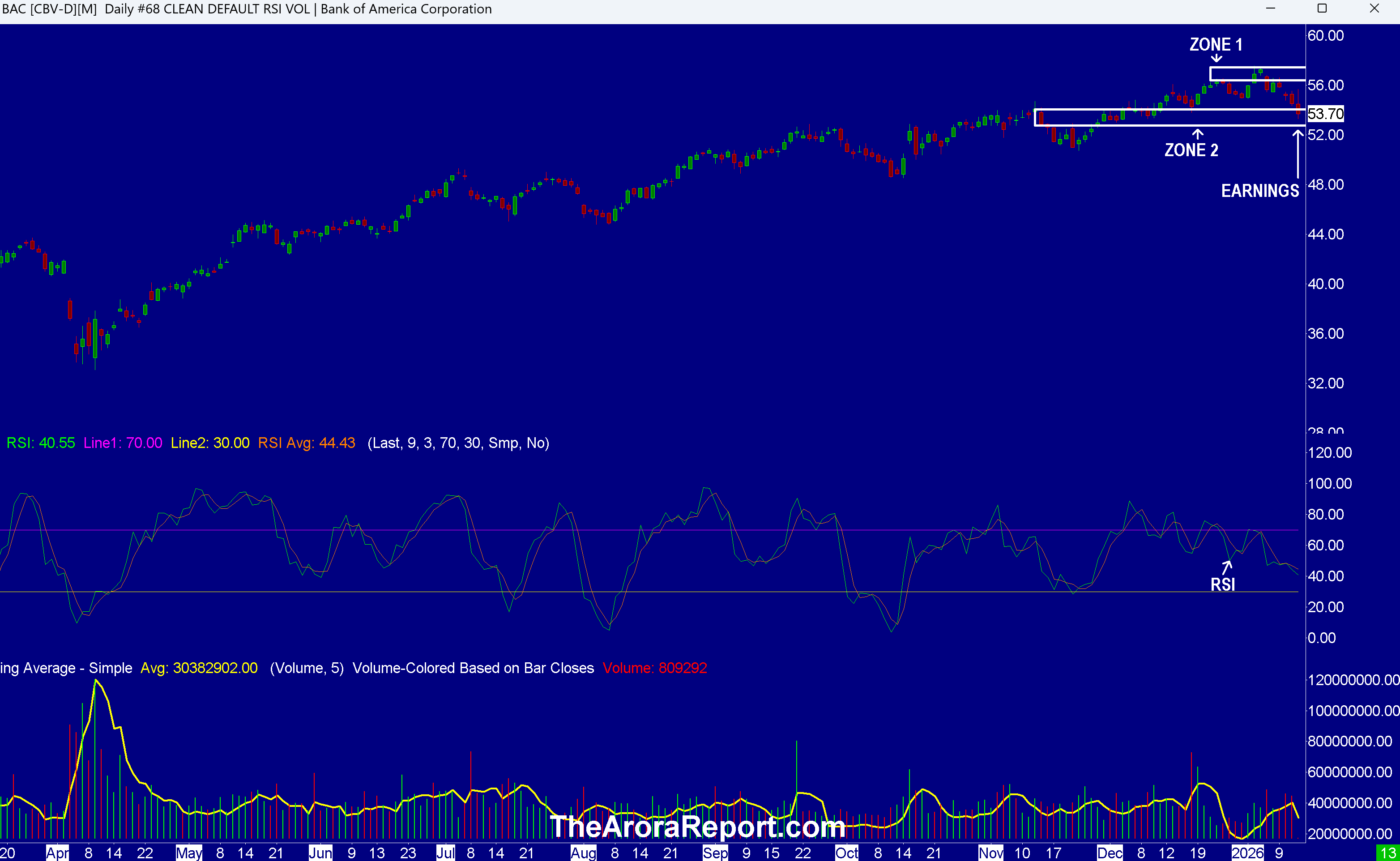

Please click here for an enlarged chart of Bank of America Corp (NYSE:BAC).

Note the following:

- This article is about the big picture, not an individual stock. The chart of BAC stock is being used to illustrate the point.

- The chart shows BAC stock has fallen in zone 2 (support) on earnings after an initial spike.

- Bank of America earnings are roughly inline with consensus but slightly below whisper numbers.

- As full disclosure, Bank of America Corp (BAC) is in our portfolio. We are long from an average of $7.69. BAC is trading at $53.70 as of this writing in the premarket.

- Citigroup Inc (NYSE:C) reported earnings better than the consensus and whisper numbers.

- As full disclosure, Citigroup Inc (C) is also in our portfolio. We are long from an average of $33.80. C is trading at $117.98 as of this writing in the premarket.

- In our analysis, at this time, C is the best stock for investors who are not already in bank stocks. C stock trades at a discount relative to other large banks. Citigroup is succeeding at the following:

- Simplifying the business

- Exiting lower return operations

- Improving efficiency and capital discipline

- Morgan Stanley (NYSE:MS) and Goldman Sachs Group Inc (NYSE:GS) will report earnings tomorrow in the premarket.

- In our analysis, artificial intelligence's second act has begun. Big banks are huge beneficiaries of the second act. AI is a structural margin expansion driver for big banks. The opportunity is on the expense side, including:

- Compliance and regulatory processes

- Fraud detection and risk management

- Customer service and call centers

- Credit underwriting and back office automation

- AI driven cost reductions flow directly to earnings, particularly at scale.

- There is credit card-related headline risk as President Trump wants to limit interest rates to 10%. Consider the following:

- In our analysis, the proposed temporary 10% credit card interest rate cap represents a manageable risk for large banks.

- In our analysis, enforcement would face significant legal challenges, and any lasting cap would likely require congressional action.

- Our call is that if credit card-related headlines trigger a significant sell off, investors should view that weakness as an opportunity, not a thesis change.

- In that scenario, investors should look to trade around existing core positions, rather than exit them.

- In our analysis, big banks have tailwinds at their back.

- President Trump wants to run the economy hot. In our analysis, there is a high probability that President Trump will succeed. This is good for big banks.

- Capital markets are strong

- Net interest income is stable

- Costs are being managed better

- At present, most portfolios are heavily weighted towards AI. In our analysis, prudent investors should be well diversified beyond AI. Banks are a good diversifiers.

- For those who like ETFs, the bank ETF State Street SPDR S&P Bank ETF (NYSE:KBE) is in our portfolio.

- Core Producer Price Index (PPI) came cooler than expected. Here are the details:

- Headline PPI came at 0.2% vs. 0.2% consensus.

- Core PPI came at 0.0% vs. 0.2% consensus.

- Prudent investors closely watch retail sales data as the U.S. economy is 70% consumer based. Retail sales are hot as consumers continue to splurge. Here is the latest retail sales data.

- November headline retail sales came at 0.6% vs. 0.4% consensus.

- November retail sales ex-auto came at 0.5% vs. 0.3% consensus.

- This morning, there are jitters that the Supreme Court may rule on IEEPA tariffs today. We previously shared with you:

The consensus is the Supreme Court will find a way to support President Trump. Prudent investors need to know that companies are already lining up to seek refunds of tariffs they have paid in case the Supreme Court rules against the tariffs. The Supreme Court decision may be market moving especially if the Supreme Court rules against the tariffs.

- There are more jitters this morning on the prospect that President Trump will decide to strike Iran. Gold and silver are seeing aggressive buying on a potential Iran strike. Silver is trading over $91 as of this writing.

China

China's December trade surplus came at $114.1B vs. $114.3B consensus. In our analysis, this data shows that the Chinese export machine continues to be strong in spite of U.S. tariffs.

Of note is that to curb rampant speculation by Chinese investors in the stock market, stock exchanges in Beijing and Shenzhen are changing margin requirements.

Magnificent Seven Money Flows

Most portfolios are now heavily concentrated in the Mag 7 stocks. For this reason, it is important to pay attention to early money flows in the Mag 7 stocks on a daily basis.

In the early trade, money flows are negative in Apple Inc (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Alphabet Inc Class C (NASDAQ:GOOG), Meta Platforms Inc (NASDAQ:META), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA).

In the early trade, money flows are negative in SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust Series 1 (NASDAQ:QQQ).

Momo Crowd And Smart Money In Stocks

Investors can gain an edge by knowing money flows in SPY and QQQ. Investors can get a bigger edge by knowing when smart money is buying stocks, gold, and oil. The most popular ETF for gold is SPDR Gold Trust (NYSE:GLD). The most popular ETF for silver is iShares Silver Trust (NYSE:SLV). The most popular ETF for oil is United States Oil ETF (NYSE:USO).

Silver

Silver is seeing a second leg of a vicious short squeeze.

Oil

Oil is being bought on the prospect of a U.S. strike on Iran.

API crude inventories came at a build of 5.27M barrels vs. a consensus of a draw of 2M barrels.

Bitcoin

Bitcoin (CRYPTO: BTC) is seeing buying due to a technical buy signal. The initial trigger was optimism about new favorable crypto legislation.

What To Do Now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the big artificial intelligence rally before anyone else, the new bull market of 2023, the bear market of 2022, new stock market highs right after the virus low in 2020, the virus drop in 2020, the DJIA rally to 30,000 when it was trading at 16,000, the start of a mega bull market in 2009, and the financial crash of 2008. Please click here to sign up for a free forever Generate Wealth Newsletter.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

- No comments yet. Be the first to comment!