Shay Boloor, the Chief Market Strategist at Futurum Equities, has highlighted three key factors that could determine the success of Advanced Micro Devices Inc. (NASDAQ:AMD) in 2026.

In a post on X on Tuesday, Boloor began by emphasizing the importance of AMD’s CPUs, which he described as the company’s “cash engine.” He said that these data center CPUs will be a key growth driver for AMD, benefiting from tight supply, strong hyperscaler demand, possible price hikes, and over 50% server CPU growth, providing operating leverage as GPUs scale.

Secondly, he pointed out that Helios, a shipment test using real customer deployments and sustained volumes, would determine whether AMD can move from a component supplier to a full platform vendor.

Lastly, the strategist says that AMD doesn't need to “beat” Nvidia (NASDAQ:NVDA); it needs major customers like Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META), Oracle Corporation (NYSE:ORCL) and Tesla (NASDAQ:TSLA) to adopt procurement rules that avoid single-vendor AI infrastructure, making AMD part of the default architecture rather than a deal-by-deal competitor.

Trump Tariffs Hit AI Chips As AMD Pushes Ahead

Boloor’s post comes as President Donald Trump, on Wednesday, imposed a 25% tariff on select high-end AI chips from companies like Nvidia and AMD is part of a broader strategy to reduce U.S. dependence on foreign-made chips, posing economic and security risks.

Nevertheless, AMD has been actively taking on Nvidia in the AI hardware market. The company recently rolled out new chips and faster systems aimed at the data center market, challenging Nvidia’s dominance in the sector.

AMD’s CEO, Lisa Su, has also predicted a massive increase in global compute demand, far beyond data centers. She believes that the world is entering the “yottascale” era of computing, which will require an unprecedented expansion of global computing capacity.

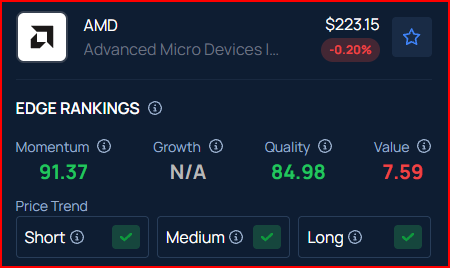

Benzinga's Edge Rankings place AMD in the 85th percentile for quality and the 91st percentile for momentum, reflecting its strong performance in both areas. Benzinga’s screener allows you to compare AMD’s performance with its peers.

Price Action: Over the past year, AMD stock climbed 86.40%, as per data from Benzinga Pro. On Wednesday, the stock edged 1.19% higher to close at $223.60.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

- No comments yet. Be the first to comment!