Rumble Inc (NASDAQ:RUM) shares are trading higher Monday afternoon after a new SEC Form 4 filed late Friday revealed substantial insider buying by entities tied to Giancarlo Devasini. Here’s what investors need to know.

- Rumble stock is surging to new heights today. What’s behind RUM gains?

Tether Fund Lifts Already-Large Rumble Stake

The filing shows Tether Global Investments Fund, S.I.C.A.F., S.A. and its wholly owned subsidiary Tether Investments, S.A. de C.V. purchased a total of 777,012 Class A shares of Rumble at an average price of $5.43.

The buying occurred over three sessions last week: 193,702 shares on Feb. 3 at $5.4899, 538,955 shares on Feb. 5 at $5.4063, and 44,355 shares on February 6 at $5.4817.

Following these transactions, the reporting entities now indirectly own about 105.2 million Rumble shares through Tether Investments, S.A. de C.V., making them significant 10%-plus owners and directors of the company.

The Form 4 notes that Devasini holds more than 50% of the voting interest in Tether Global Investments Fund, giving him voting and dispositive power over the stake.

Why The Buying Pushes RUM Stock Higher

Markets often view sizable insider or major-shareholder purchases as a strong vote of confidence in a company's outlook. Adding nearly 800,000 shares suggests the Tether-linked investors see Rumble's current valuation as attractive and are willing to commit additional capital.

That signal can draw in momentum traders and long-term investors, increase demand for the stock, and potentially pressure short sellers, all of which tend to push RUM shares higher in the short term

Rumble Stock Faces Mixed Momentum

The stock’s upward movement comes amid a generally favorable trading environment, with strong performances in major indices. Investors are encouraged by the overall market momentum, which often bolsters individual stock performance.

Technical indicators show that Rumble is currently trading 4.1% above its 20-day simple moving average (SMA) but is 4.1% below its 50-day SMA, indicating some short-term strength while struggling with longer-term trends.

Over the past 12 months, shares have decreased by 49.06%, and they are currently positioned closer to their 52-week lows than highs, suggesting ongoing challenges for the stock.

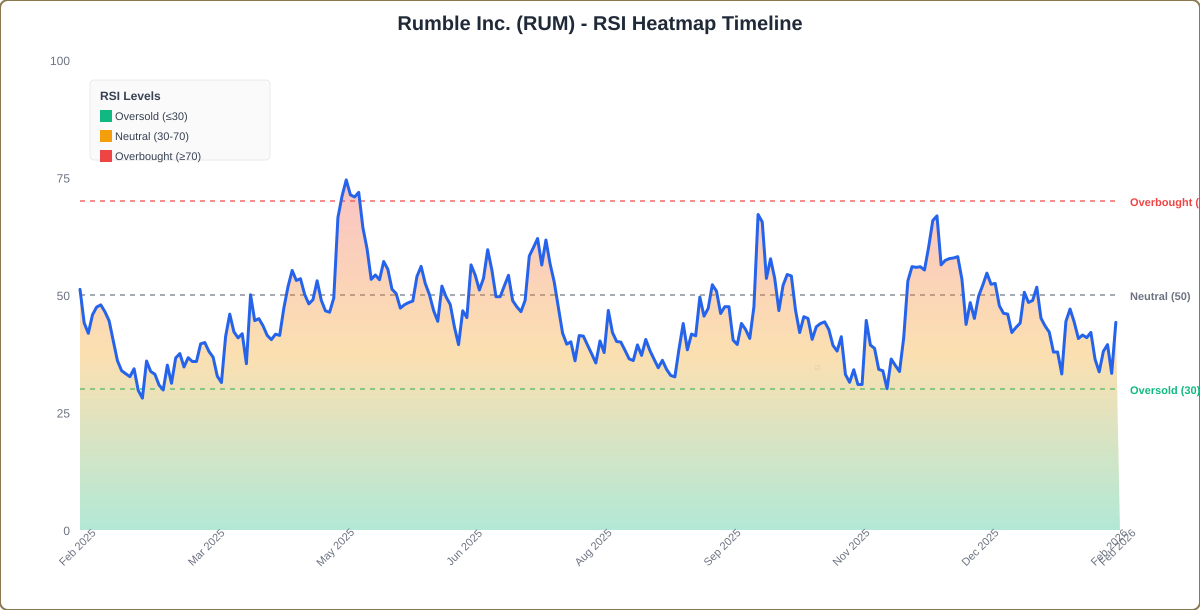

The RSI is at 45.66, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, reflecting uncertainty in the stock’s direction.

- Key Resistance: $6.50

- Key Support: $6.00

Benzinga Edge Rankings

Benzinga Edge data shows Rumble has a Momentum score of 3.61, while its price trend is flagged bearish across short-, medium- and long-term timeframes, underscoring ongoing technical weakness despite Monday's gains.

RUM Stock Surges Monday Afternoon

RUM Price Action: Rumble shares were up 9.00% at $6.31 at the time of publication on Monday, according to Benzinga Pro data.

Image: Shutterstock

- No comments yet. Be the first to comment!